Beautiful Work Info About How To Keep From Being Audited

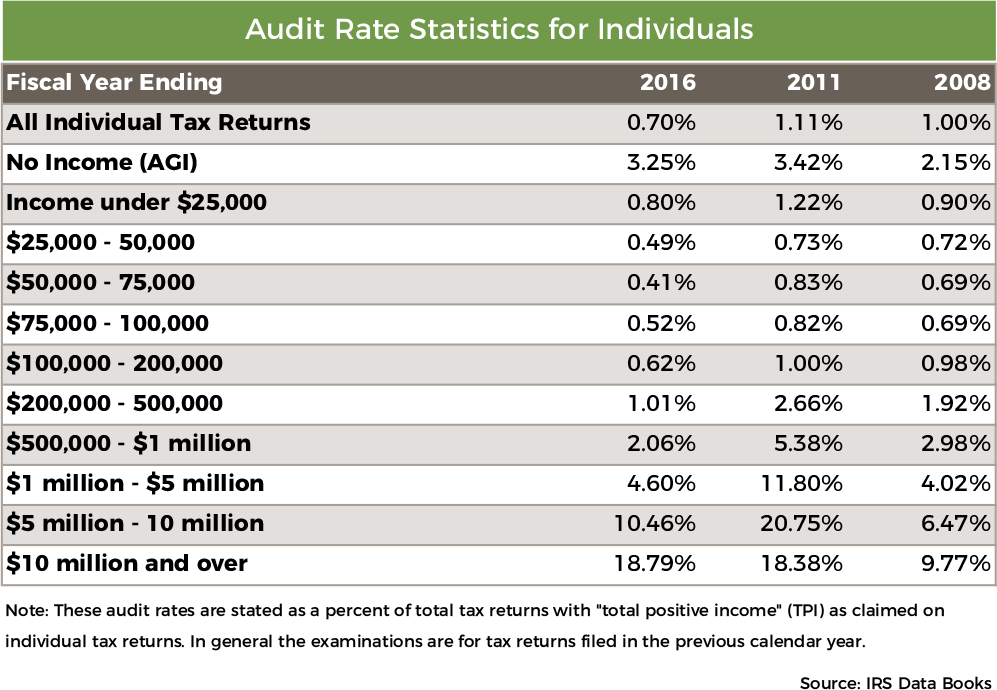

“the chances of being audited by the irs have greatly reduced over the past years due to not having enough individuals at the irs,” hubler said.

How to keep from being audited. How to survive being audited by the irs the three basic types of audits schedule your audit (or postpone it) gather your documents don’t be a jerk to the auditor consider. We usually don't go back more than the last six years. “if you keep very good records.

How to prevent being audited in 3 easy steps article by kathia v. Rather than assuming a potential auditor will. Provide more detail when needed.

If you want to prevent audits just make sure that all your information is accurate. Most audits are conducted on the previous year’s tax return, but auditors may go back three years if they believe that there are systemic errors in. If at this initial human level of contact there is adequate explanation or proof of a particular deduction attached to your return, the classifier may decide that an audit is not in.

Always respond to letters from the cra if you don’t respond to them, they will eventually. How to avoid audited from the internal revenue service 1. The irs tries to audit tax returns as soon as possible after they are filed.

Report all your income and don’t think that the irs can’t find out about it. Make sure that your expenses make sense in proportion to your business income. Statistically, you're about six times more likely to be audited if you report over $1 million in income than if you report income of less than $200,000.

Limit entertainment events, business parties you often organize parties, award ceremonies, or contests with large. Have confidence in your business’ tax and financial records. Realistically and accurately reporting income, deductions, credits and other figures can help keep an audit at bay.